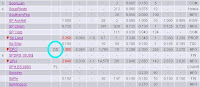

Once a company has declared dividends, there will be a CD sign beside the name of the company. CD stands for cum-dividend and it is a notice that the company will be paying out dividends soon. I have attached an an example of this with regards to SPC i.e. Singapore Petroleum Company. In this example, you can see the CD sign beside SPC.

If you click on "SPC" on SGX's website, you will be directed to another page. After that, if you click on "Past or Outstanding Bonuses, Dividends, Interests, Offers, Rights and Other Entitlements", you will be able to see the past or outstanding dividends payment record along with other important dates such as the Ex date, Book closure date and payable date. Below are the examples of the "Past or Outstanding Bonuses, Dividends, Interests, Offers, Rights and Other Entitlements"for SPC respectively.

One important thing you should take note is the Ex date. On this date, the stock will have a XD sign beside it. XD stands for ex-dividend and if you buy on this date or after this date, you will not receive the dividends. Thus if you wish to receive the dividend, you should buy before this date.

Subsequently, the dividends will be credited to your bank account as stipulated in your CDP account or a cheque will be send to your address as stipulated in your CDP account on the date payable. For payments to your bank account, there will be a transaction code 'CDP' beside the payment in your online bank account statement.

Last couple of years, including last year, I used to get a statement from CDP, which lists tax-exempt and tax-deducted dividend statement (at 20% tax).

ReplyDeleteLater, I used to claim the excess paid tax (@20%), since my max. brackets falls in 8.5% tax bracket.

However, this year CDP statement did not contain tax-deducted or tax-exempt list. My stock holdings are mostly the same last year and this year.

I don't have a copy of last year dividend statement to compare.

Do you have any info? I read about one-tier tax exemt on iRAS, however i'm confused this year.

Hi,

ReplyDeleteActually I'm not very sure regarding this. From what I know, under the one-tier tax exempt system, dividends are not taxable since the profits from the company, which is where the dividends came from, are already being taxed at the corporate level. You might want to check out the forum thread @ http://forum.channelnewsasia.com/viewtopic.php?t=218880&postdays=0&postorder=asc&start=0&sid=26d3e06f1a8e63afd5af01784d81b2c2. I hope it helps.

Kay

Thanks Kay for the pointer. However, it's unclear and might remain one.

ReplyDeleteLast year, of all the dividends I received, companies/cdp withheld 20% tax. And then while filing, I claimed the excess tax paid of dividends, since my max. bracket is taxed at 8.5%.

I'll dig through the details to get the above cleared over weekend.

Hi Kay,

ReplyDeleteIf I hold the shares after XD, can I sell the shares after the XD even when the dividends have not been credited into my CDP account?

Or I have to hold it till the money is credited into my account?

Hi,

ReplyDeleteYes, you can sell your shares after XD and the dividends will still be credited to you.

Kay

Thanks, Kay. I'm a newbie at shares investment and find your blog really useful. Keep up the good work! =D

ReplyDeleteHi,

ReplyDeleteI'm glad you found my blog to be useful. Thanks for your compliment.

Hi Kay,

ReplyDeleteNewbie here..could advise what is meant by OFFER 1 for 4? If i am holding 3 lots of that shares....what will happen?

Thanks

REX

Hi Rex,

ReplyDeleteIf you are referring to a rights issue, it means you will receive 1000 rights for every 4000 shares you have. Thus if you have 3000 shares i.e. 3 lots, you will receive 750 rights.

Kay

Hi Kay,

ReplyDeleteI stumbled upon your blog when I was looking for a list that details the companies (listed on SGX) that pay out regular dividends. Do you know where I will be able to obtain this list?

Many Thanks

Ling

Hi Ling,

ReplyDeleteI'm not sure if such a list is available. What I do is that usually, I go the SGX website and see the historical dividends of the company that I'm interested. If the historical dividends have been regular and the company has been paying dividends for a long time, then it should be paying regular dividends. In general, blue chips and GLCs pay out regular dividends.

Regards,

Kay

Hi Kay,

ReplyDeleteI saw there is Buy-In Last Cum Date which is a few days later than the Ex Date (XD). If I buy the shares after XD but before this Buy-In Last Cum Date, will I still get the dividend?

Thanks

Ponny

Hi Ponny,

ReplyDeleteYou must buy it before XD to receive the dividends.

Kay

hi all i am a newbie in investing. I am just wondering seems we buy b4 the XD date we got dividend is it true that i just go search any stocks that going to give dividend soon and buy it and after that sell it off after recieving devidends. Is it a good way to earn a bit of money here and there??

ReplyDeleteHi Warrior,

ReplyDeleteYou will get your dividend if you buy it before XD. However, the price of the stock which you have bought to receive the dividend will drop by the amount of dividend that you will be receiving after XD in theory thus this strategy will not be profitable consistently.

Kay

Is it true that once it turned XD, we can start selling the shares and will still get the dividend?

ReplyDeleteHi Maths Tuition,

ReplyDeleteYes. That is true.

Kay

Hi Kay,

ReplyDeleteI understood your explanation. Just buy when the counter shows "CD" in order to get dividend.

The question I have is "What should I do with the stock after I got the dividend?"

"Do I need to sell the stock and buy it back again when it shows "CD" again?"

Hi,

ReplyDeleteWhat you should do with the stock after you get the dividend depends on your opinion of the company. If you think that the company satisfies your investment criteria, you should keep it by all means and vice versa. One thing you should take note is that you cannot profit consistently by buying in just before CD and selling the stock after you have collected the dividend. This is because after XD, the stock price will drop by amount equivalent to the amount of dividends theoretically thus your net gain will be zero.

Kay

Hi

ReplyDeleteI have bought some shares before XD, but if I sell them before Buy-In Last Cum Date, will I still be abled to receive the dividend?

Thank you!

Sze

Hi Sze,

ReplyDeleteI believe you should be able to receive the dividend.

Kay

thanks for the info. its a bit outdated but the process its still pretty much the same.

ReplyDeleteI am a fan of stock dividend investing. But be careful to not get carried away and be tempted to chase stocks with big yields. Generally speaking the higher the yield the higher the risk in owning the stock.

ReplyDeleteinterested to start earning some passive income, but doesn't know where to start. correct me if i am wrong. first is to have a CDP account and a brokerage platform, then buy your desirable stock. did i miss out any steps?

ReplyDeleteThanks for taking the time to discuss this, I feel strongly about it and love learning more on this topic. If possible, as you gain expertise,

ReplyDeleteI brought some stock during CD. I still have not receive dividend after the dividend payout date. What can I do?

ReplyDeleteHi,

ReplyDeleteIf I lost the cheque that CDP send to me, any way that i can re claim the dividend?

Thank you !

Andrew

Hi,

ReplyDeleteI just need some clarification.

I understand that you said that if stock bought on the "EX" date, then no dividend would be given.

What about Closure date? Because you also say that dividend will still be receive if stock are sold on the "EX" date.

If closure date was 12th Nov and "ex" was on the 9th. Will i still get dividend if i buy/sell on 9th?

Because when i read the "NOTICE OF BOOKS CLOSURE" of my stock in SGX, it says "Units registered at 5.00 p.m. on 12 November 2013 will be entitled to the Distribution."

Thanks

D.J