The above title is more commonly known as buy term and invest the rest or in short, BTITR. This is a topic which has been widely discussed before. As compared to the BTITR approach, the other alternative is to buy whole life insurance and this has been a more popular approach for Singaporeans. However, the more popular approach need not be the better approach and in this post, I will attempt to show why is this the case.

As taken from the guide to life insurance from the Life Insurance Association of Singapore or LIA in short, whole life insurance offers life-long protection. Premiums will be paid throughout your life although this can be changed to a limited period and this policy will pay out the sum insured and any bonuses you have built up when you die or become totally and permanently disabled.

In contrast, term insurance only offers protection for a set period of time and it will pay the sum insured when you die or become totally and permanently disabled.

The BTITR can be a better approach as the returns from investing the difference in the premiums between the whole life insurance and term insurance can be potentially higher than the sum assured from the life insurance policy when the coverage for the term insurance has ended.

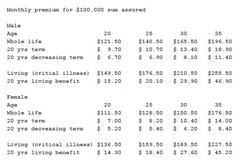

As a rule of thumb, the premiums for term insurance is around ten times cheaper than the premiums for the life insurance. As such, we can use the difference in the premiums to invest. The table below, which is taken from Tan Kin Lian’s blog, who is the ex-CEO of NTUC Income, shows a comparison of the premiums for the difference type of policies and the link can be found here.

For the returns of the life insurance, the returns is likely to be around 3% and this is taken from a article on Tan Kin Lian’s website. The poor yield of life insurance policy is due to the expenses and marketing costs incurred by the insurance companies and these costs can be up to 4.5%. More details can be further found here in this article on Tan Kin Lian’s website. As such, if you are investing in the same type of investment portfolio exactly by the insurance companies, your potential returns would be around 3% + 4.5% = 7.5%. The difference when compounded over a long period of time can affect the overall returns significantly.

Now how can we get a returns from investments that amounts up to 7.5% ? One way will be to invest in an index fund such as the STI ETF or the DBS STI ETF 100. In the long run, you should be able to get a return of around 7% and if you factored in the fact that dividends are also being paid out, the returns is likely to be higher than 7%. You can find out more about the STI ETF and the DBS STI ETF 100 on my site.

Let me illustrate with a simple example on why the BTITR can be a better approach. Using the data which I have discussed above, I am going to do a comparison between buying life insurance and the BTITR approach.

Whole life policy for sum assured of $100,000 and a term insurance for sum assured of $100,000 for a period of 30 years bought at the age of 25.

Whole Life (WL) : $140.50 per month compounded at 3%

Term insurance (TI) : $140.50/10 = $14.05

Difference in premiums : $140.50 - $14.05 = $126.45

This difference in premiums will be used for investing in an index fund which is projected to give a return of 7.5% over a long period of time.

At the end of 20 years

Sum assured for WL : $100,000

Since $140.50 compounded at 3% for 20 years will be $46,126 and this is less than the sum assured

Sum assured for TI: $100,000

Invested returns for difference in premiums: $70,019

Since $126.45 compounded at 7.5% for 20 years gives $70,019

One day before the end of 30 years.

Sum assured for WL : $100,000

Since $140.50 compounded at 3% for 30 years will be $81,875 and this is less than the sum assured

Sum assured for TI: $100,000

Invested returns for difference in premiums: $170,385

Since $126.45 compounded at 7.5% for 30 years give $170,385

At the end of 30 years

Sum assured for WL : $100,000

Sum assured for TI : $0 (Since coverage for term insurance ceases at the end of 30 years)

Invested returns for difference in premiums : $170,385.

As you can see, if the investment is done properly, the invested returns is higher than the sum assured by the whole life insurance even though the coverage for the term insurance has already ended. In other words, you will be enjoying an even higher coverage than it is possible from the life insurance and this is the advantage of using a BTITR approach.

As much as the BTITR approach sounds promising, it may be difficult to implement it. In my subsequent posts, I will be discussing on the difficulties of implementing this approach and suggest a way of implementing it practically.

The opinions expressed by the author in this article is provided for your personal information only and should not be constituted as financial advice. It is recommended by the author that one should seek the advice of a qualified financial adviser with any issues or questions regarding financial matters.

Theoretically what you propose is true, but practically it's hard to achieve a consistent 7.5% throughout (for eg, like in a recession or cyclical downturn, the investment may go -ve). Furthermore, for term insurance, since you keen paying, the premiums increase as you grow older, hence it gets more expensive over time. (Insurers only accept term insurance up to a certain age limit, ie when you are 60+, you may not be able to be covered anymore) For LP, you may be able to pay off in 10-20 years, hence reducing the need to worry about insurance premiums after that (also generally as you are healthy in younger years, the premium for LP pay be less than that for TP as you get older and more sickly). Just some food for thought =)

ReplyDeleteHi,

ReplyDeleteI would like to agree that 7.5% pa is abit high and not easy to maintain, especially STI ETFs. Moreover, STI is dependent on Singapore's economy as a whole and going forward, we may not know what's in store for the country.

Is there any ETFs that focus on the World's economy as a world? I understand that this year, it is expected that the economy of the World will contract by 2+%, but generally speaking for the past decades, the world economy is expanding. Even though not much, but it's very safe, and conservatively speaking, growing.

We may not want a situation when the world is growing and Singapore is not performing. Frankly, I believe Singapore is at some sort of peak (Golden Years) and it might help to look at other growing options other that STI.

Hope my comments add on. :)

Hi Anonymous and Willie,

ReplyDeleteThanks for your invaluable feedback. There are some interesting points which were raised and I will attempt to address them.

It is not possible to achieve returns of 7.5% every single year if your investment holding period is short. However, it is possible to achieve it in the long run. Specifically, with reference to my post, 30 years is a long enough time frame. To put things in perspective, the Straits Times Index is in the region of around 800 points in 1987, as compared to a level of around 2200 points currently, with a previous peak of 3900. As for the Dow Jones Industrial Average, it was around 800 points 30 years ago, as compared to a level of around 8000 points currently, with a previous peak of 14000. If the effects of reinvested dividends are taken in account, I would say that a average annualized return of 7.5% over the next 30 years is achievable as suggested from the past.

If you are worried about the future state of the economy of Singapore, you can buy index funds or ETFs which track the MSCI World Index. As the name suggests, it tracks 1500 stocks from the developed economies in the world. The reason why I recommend the STI ETF or the DBS STI ETF 100 is that it does not involve currency risk. Certainly, other major indices has the potential to give back a higher return as compared to the Straits Times Index but currency risk and fluctuation adds on an another layer of complexity to any potential returns.

You can buy term insurance which has a fixed and guaranteed premiums. Try to seek an insurance broker or an independent financial adviser i.e. IFA who carrys insurance products from the majority of insurance companies in Singapore and they should be able to advise you on the better deals.

It may be true that you can pay off your life insurance policy at the end of a maturity period. On the other hand, after buying term and investing the rest for a period of time, the dividends from the investment should be able to cover the premiums for the term insurance while your investment still has the potential to appreciate capitally although I don't advise anyone to do that.

At an age of 60, it is likely that you will not have any dependents since your children are likely to be already financially independent. Thus if you do not have any dependents, you will not need to have any insurance coverage.

For the same amount of coverage, the premiums for life insurance is much higher than term insurance. In order to ensure a sufficient amount of coverage, the premiums for this amount of coverage for life insurance can be very expensive and it may be unaffordable.

Regards,

Kay

Dear Kay,

ReplyDeleteI bought an investment-linked life insurance ten years ago with a monthly premium of $100 and another traditional life policy three years ago with annual premuiums of around $1800. Does it make sense for me now to give up these policies and buy term insurance instead? i also discovered that my coverage is also very little, definitely less than $400K.

Would appreciate your advice!

Rgds

Learner

Hi Learner,

ReplyDeleteSince a large part of the premiums of such insurance is being expensed initially and your policies were bought quite some time ago, it may not be prudent to give up these policies. If you think that your coverage is insufficient, you can buy term insurance to cover this gap and keep your existing policies.

Regards,

Kay

Hi Wiz Kay !!

ReplyDeleteInvestments are better as you said. It seems very little knowledge being imparted on insurance part. Anyone who knows a rider called OPP (option to purchase paid up) in a whole life policy, this will beat the inflation. I would advise anyone to be prudent with their principal, guarantees and long term goal by placing their money in safe insurance policy with an OPP rider and the effective return will be 5.5% tax free.

Hi,

ReplyDeleteThat's pretty interesting. Can you elaborate more on this OPP ?

Kay

Thanks. Luckly I did not buy additional living/life policy. I have 2 life policies, one with Prudential and another one with NUTC, total pay $200+ monthly and total sum assured about $200k. I found that LUV not bad, pay only $40 monthly sum assured $200k included critical illness. To increase my sum assured, I will get the LUV.

ReplyDeleteHi,

ReplyDeleteI think it's still alright since you are only paying $200 plus monthly. But I got a hunch that the total sum assured is not sufficient for you. By the way, can you enlighten me on what is LUV ? Thanks.

Kay

This theory is only useful if you have the knowledge and disciplined enough to do your own investment.

ReplyDeleteSo folks, do not just follow what's written.

Hi,

ReplyDeleteThe knowledge involved is not really rocket science. If one takes some time to read and understand the information on my website such as this article and articles on insurance and ETFs, it shouldn't be too difficult for one to do this. However, everyone's temperament toward investment may be different and some may not be able to stomach any volatility in their investment so this method may not be suitable for everyone.

Kay