Bid for S'pore Govt Securities via ATMs

Move allows investors easier access to liquid and safe alternative

By Gabriel Chen(Taken from the Straits Times on 30th June 2009)

Investors will be able to submit bids for Singapore Government Securities on ATMs once an auction announcement has been made on the SGS website.

Investors will be able to apply for Singapore Government Securities (SGS) - debt instruments in the form of either Treasury bills (T-bills) or bonds - by using ATM machines from tomorrow.

Quick Facts

- SGS are debt instruments issued by the Government. They can be in the form of Treasury bills or bonds.

- The minimum investment amount is $1,000, and you can invest in multiples of $1,000. You can use your CPF.

- You can apply through all DBS Bank, United Overseas Bank and OCBC Bank ATMs.

- Investors will need a valid individual Central Depository account number. There will also be minimal administrative fees.

The securities ride on the strong credit strength of the Singapore Government and have, arguably, not been very accessible to retail investors.

- SGS can be sold at any of the three local banks.

Up to now, retail investors have only had exposure to them through money market funds, primary dealers like the three local banks, or secondary dealers, such as stockbrokers.

With effect from tomorrow, individuals can apply for SGS via all DBS Bank, United Overseas Bank and OCBC Bank ATMs.

With the changes - officially announced by Monetary Authority of Singapore chairman Goh Chok Tong last Friday - investors can head to ATMs to submit bids once an auction announcement has been made on the SGS website (www.sgs.gov.sg).

The bids can be either competitive or non-competitive.

A competitive bid is one where a bidder has to specify the price he is willing to pay for the securities and is allocated securities if his bid is high enough in comparison to others. A non-competitive bid is one where the bidder does not specify a price.

The price is expressed in terms of percentage yield.

Similar to an Initial Public Offering (IPO) application, investors will need a valid individual Central Depository (CDP) account number. Minimal administrative fees will also be charged by CDP.

Investors can sell SGS via the three local banks.

Tuesday, June 30

Bid for S'pore govt securities via ATMs

Saturday, June 27

Boom in resale homes

Boom in resale homes

By Joyce Teo

(Taken from the Straits Times on 25th June 2009)THE mini boom that started in the sale of new flats has now spread to the resale homes market, with transactions rocketing 71 per cent in the second quarter.

Sellers have quickly become attuned to the unexpected resurgence in demand and are jacking up asking prices, according to consultants Jones Lang LaSalle.

Much of the demand is coming from HDB upgraders who are still able to get reasonable prices for their flats, allowing them to move up the housing ladder.

The activity in the resale market follows strong sales of new private homes. Levels have exceeded 1,000 units every month since February compared with a monthly average of 330 units last year. Prices are also showing resilience amid the downturn, with resale prices beginning to rise in all categories.

The property sector rallies seem to contradict prevailing economic realities, industry experts acknowledge. DTZ's head of Southeast Asia research, Ms Chua Chor Hoon, told a property seminar yesterday that it is too early to tell if the Singapore market is on its way to recovery: 'Unlike Hong Kong, we don't have a China behind us.'

Jones Lang LaSalle's head of research for Southeast Asia, Dr Chua Yang Liang, told The Straits Times: 'My concern is that the price rise in the resale market is not supported by economic growth or personal income growth.' It is instead largely backed by money earned in the previous bull run, which is not sustainable, he said.

Resale demand, said Jones Lang LaSalle, is largely for finished projects, driven by the need for immediate occupation and good rental yields. Prelimary second-quarter estimates show HDB upgraders accounted for 46 per cent of resale deals, up 11 percentage points from a year ago.

HDB prices have not fallen much, so owners can still sell at attractive prices and upgrade to a private home. The demand has pushed up resale prices, even though affordability remains key.

While prices of freehold units were down 14.6 per cent on a per square foot (psf) basis in the second quarter, new mass market home prices were up nearly 7 per cent, said a CBRE Research statement yesterday. Subsale prices of 99-year leasehold apartments rose by 22 per cent in the second quarter.

When compared with prime market sectors, the mass market segment shows the highest rebound, said Jones Lang LaSalle. Average resale prices were up 9.4 per cent to $580 psf in the second quarter compared with the first quarter.

They are now 49 per cent above the low point of the second quarter of 2005 but remain about 17 per cent below the first quarter peak last year.

Average resale prices of prime luxury homes rose 7.8 per cent from the first quarter to $1,800 psf in the second quarter. But this is a fall of 45 per cent from the second quarter of 2008.

Some buyers are increasingly more willing to commit as they believe this discount is sufficient, said Jones Lang LaSalle. For instance, resale deals at Ardmore Park were done at an average of $2,146 psf in the second quarter compared with one deal at $1,976 psf in the first quarter.

Some analysts warn of too much exuberance given the ample supply and falling rents but others are more positive. A recent Credit Suisse report said that while new homes sales may slow, the resale market is likely to pick up the slack. An earlier UBS Investment Research report highlighted the rise in resale deals as evidence of sustainable recovery in the physical property market.

Wednesday, June 24

Difficulties in implementing a buy term, invest the rest plan

This post is part of a series of posts that discuss about the buying term insurance and invest the rest in detail. To access the other posts in this series, click here.

To implement a BTITR plan, you will need to set aside a fixed amount of money each month for investing. This by itself, requires discipline. Are you willing to set aside a fixed amount of money each month regardless of any circumstances that may happen to you for the next few decades ? The use of a GIRO plan for Dollar Cost Averaging or DCA or a Regular Savings Plan or in short RSP, if you are buying into a unit trust may prove to be helpful to maintaining this discipline. If you are ok with this, we can move on to the next issue.

The recommended investment will be to invest in exchange traded funds or ETFs in short, such as the STI ETF or the DBS STI ETF 100. Other alternatives will be to invest in index funds such as the Infinity series which tracks the S&P 500, which is a US stock index and the MSCI World Index although their expenses seems to be a little bit high.

As with all investments in equities, there may be fluctuations in the prices of the investments that you are buying and holding onto. If there is a huge drop in the price of these investments, can you still maintain the discipline to ignore these fluctuations and continue to invest regularly ? If you are still committed to carry out the investment, we will move on to the last issue.

Will you be tempted to cash out on some of your investments to fulfill your indulgences such as buying the latest gadgets or getting a new ride ? For the BTITR plan to work, the investments must be not be cashed out so that returns can be compounded to give better returns.

Do think about these issues carefully. If you do not have the discipline to stay to a BTITR plan, the consequences can be severe as you can find yourself being without sufficient coverage when your term insurance ceases. If that is the case, it may be better to buy a life insurance if you need one despite of the poor returns. In my next post, I will cover on how can one implement a BTITR plan practically.

The opinions expressed by the author in this article is provided for your personal information only and should not be constituted as financial advice. It is recommended by the author that one should seek the advice of a qualified financial adviser with any issues or questions regarding financial matters.

Thursday, June 18

Buy term insurance and invest the rest

The above title is more commonly known as buy term and invest the rest or in short, BTITR. This is a topic which has been widely discussed before. As compared to the BTITR approach, the other alternative is to buy whole life insurance and this has been a more popular approach for Singaporeans. However, the more popular approach need not be the better approach and in this post, I will attempt to show why is this the case.

As taken from the guide to life insurance from the Life Insurance Association of Singapore or LIA in short, whole life insurance offers life-long protection. Premiums will be paid throughout your life although this can be changed to a limited period and this policy will pay out the sum insured and any bonuses you have built up when you die or become totally and permanently disabled.

In contrast, term insurance only offers protection for a set period of time and it will pay the sum insured when you die or become totally and permanently disabled.

The BTITR can be a better approach as the returns from investing the difference in the premiums between the whole life insurance and term insurance can be potentially higher than the sum assured from the life insurance policy when the coverage for the term insurance has ended.

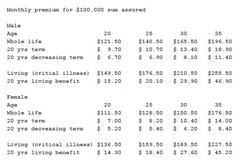

As a rule of thumb, the premiums for term insurance is around ten times cheaper than the premiums for the life insurance. As such, we can use the difference in the premiums to invest. The table below, which is taken from Tan Kin Lian’s blog, who is the ex-CEO of NTUC Income, shows a comparison of the premiums for the difference type of policies and the link can be found here.

For the returns of the life insurance, the returns is likely to be around 3% and this is taken from a article on Tan Kin Lian’s website. The poor yield of life insurance policy is due to the expenses and marketing costs incurred by the insurance companies and these costs can be up to 4.5%. More details can be further found here in this article on Tan Kin Lian’s website. As such, if you are investing in the same type of investment portfolio exactly by the insurance companies, your potential returns would be around 3% + 4.5% = 7.5%. The difference when compounded over a long period of time can affect the overall returns significantly.

Now how can we get a returns from investments that amounts up to 7.5% ? One way will be to invest in an index fund such as the STI ETF or the DBS STI ETF 100. In the long run, you should be able to get a return of around 7% and if you factored in the fact that dividends are also being paid out, the returns is likely to be higher than 7%. You can find out more about the STI ETF and the DBS STI ETF 100 on my site.

Let me illustrate with a simple example on why the BTITR can be a better approach. Using the data which I have discussed above, I am going to do a comparison between buying life insurance and the BTITR approach.

Whole life policy for sum assured of $100,000 and a term insurance for sum assured of $100,000 for a period of 30 years bought at the age of 25.

Whole Life (WL) : $140.50 per month compounded at 3%

Term insurance (TI) : $140.50/10 = $14.05

Difference in premiums : $140.50 - $14.05 = $126.45

This difference in premiums will be used for investing in an index fund which is projected to give a return of 7.5% over a long period of time.

At the end of 20 years

Sum assured for WL : $100,000

Since $140.50 compounded at 3% for 20 years will be $46,126 and this is less than the sum assured

Sum assured for TI: $100,000

Invested returns for difference in premiums: $70,019

Since $126.45 compounded at 7.5% for 20 years gives $70,019

One day before the end of 30 years.

Sum assured for WL : $100,000

Since $140.50 compounded at 3% for 30 years will be $81,875 and this is less than the sum assured

Sum assured for TI: $100,000

Invested returns for difference in premiums: $170,385

Since $126.45 compounded at 7.5% for 30 years give $170,385

At the end of 30 years

Sum assured for WL : $100,000

Sum assured for TI : $0 (Since coverage for term insurance ceases at the end of 30 years)

Invested returns for difference in premiums : $170,385.

As you can see, if the investment is done properly, the invested returns is higher than the sum assured by the whole life insurance even though the coverage for the term insurance has already ended. In other words, you will be enjoying an even higher coverage than it is possible from the life insurance and this is the advantage of using a BTITR approach.

As much as the BTITR approach sounds promising, it may be difficult to implement it. In my subsequent posts, I will be discussing on the difficulties of implementing this approach and suggest a way of implementing it practically.

The opinions expressed by the author in this article is provided for your personal information only and should not be constituted as financial advice. It is recommended by the author that one should seek the advice of a qualified financial adviser with any issues or questions regarding financial matters.

Monday, June 15

ATM guide to right issue

Friday, June 12

Why buy insurance ?

The main reason why one should buy insurance is to protect you and your loved ones from any catastrophic financial losses as a result of any unforeseen mishap or circumstances that may arise. How about considering the situations below ?

You are driving a car on the highway and you crashed into the back of the car in front. It turns out that the repair cost of the car in front is significant and you are deemed to be liable for it. Do you have the money to pay for the damages ?

As such, do keep in mind the reason on why you are buying insurance. And if you keep it in mind, you should always consider the amount of coverage you are getting and getting a sufficient amount of coverage. Don't think of insurance as a form of investment where you are supposed to get some profits back at the end of the day. Consider it as a small amount of expenses that will hedge any unforeseen huge financial losses arising from unforeseen circumstances. In fact, you should separate your insurance needs from your investment goals.

Monday, June 8

We want to retire here, but can we afford it?

We want to retire here, but can we afford it?Singapore is a good place to retire indeed as it is a rather cosmopolitian and safe place to live in. The level of healthcare is also excellent here. However, it may be too expensive for us to retire comfortably due to the high cost of living here and the social welfare support, which is only available at the basic level, is not helping too.By Lediati Tan

(Taken from the New Paper on June 07, 2009)

YES, I would love to grow old in Singapore, but it's too expensive.

These sentiments were revealed in a study released yesterday on public perception and attitudes towards ageing and seniors.

The study, commissioned by Council for Third Age (C3A), covered 2,000 Singaporeans and permanent residents, aged 16 and above, between last 28 Nov to 23 Dec.

A majority - 74 per cent - expressed their wish to grow old and retire in Singapore, but only 56 per cent felt that it was affordable to do so. (See report on right.)

Significantly, only 47 per cent of those aged 65 and above - the lowest among the six age groups - felt it was affordable to grow old here.

Respondents told The New Paper that medical cost is their top concern. Handyman Bob Lee, 52, said it was a case of 'can die but cannot fall sick'.

He said: 'The cost of living here is very high. When you grow old, there will be more than once when you end up in hospital. The medical bills are very expensive.'

Based on his own experience, Mr Lee said that when he sought treatment at a private hospital, he ended up with a $30,000 hospital bill, of which half was covered by his insurance.

However, marketing communications executive Lee Junxian, 25, and retiree Peggy Chang, 60, felt that Singapore is generally affordable.

Said the younger Mr Lee: 'There's a perception here that it's quite expensive to grow old. But I think that if you plan for retirement, government subsidies are quite sufficient.

'It's really about being prudent. If you are responsible, retiring in Singapore shouldn't be a problem.'

He said that it was important to plan for old age by having adequate health insurance and savings.

He added that insurance coverage and government subsidies helped cover 80 to 90 per cent of his grandfather's dialysis cost.

Agreeing, Madam Chang said: 'You must be prepared. You cannot depend on your children or the Government.

'Those who are not medically fit and are without health insurance, the medical bills can be really expensive, and it will be a problem.'

The older Mr Lee, however, felt that it will be difficult for the average Singaporean to plan for retirement if they are already struggling to make ends meet.

He said: 'For the average person, it's a struggle to make a comfortable living. You can't really think of retirement, unless you are wealthy enough with lots of reserves.

'I look at my friends, and see a lot of people struggling, especially with home mortgage and other things. They cannot make retirement plans themselves.'

Commenting on the results, C3A chairman Gerard Ee stressed the importance of reaching out to all age groups and educating them on retirement planning.

He said: 'People now live a lot longer - which means they need to have a strategy and an idea of the quality of life they would like, and how much they will need to set aside for it, and then save adequately.'

SURVEY RESULTS

Those who want to retire in Singapore:

Overall: 74 per cent

Those who think it's affordable to retire in Singapore:

Overall: 56 per cent

Breakdown by age group

16-24 years old: 50 per cent

25-34 years old: 56 per cent

35-44 years old: 59 per cent

45-54 years old: 59 per cent

55-64 years old: 61 per cent

Above 65 years old: 47 per cent

Thursday, June 4

50% profits from buying near bottom

This is one of the accounts which I'm looking after. I purchased a modest amount of the STI ETF near the market bottom and the current price is somewhere off the initial purchase price already so. I'm not doing this to show that it is possible to pick the bottom as I think it is almost impossible for anyone to time the market precisely. But I do think that buying in when the stock market is undervalued is something which can be done. And this is also the time where the majority of the market players are too fearful to buy but it is also possible for investors to overcome their natural instinct of fear during a market plunge and buy in. Unfortunately, my initial purchase price for my own account is not that low although I'm still sitting on a decent amount of paper profits.

I'm sure there are quite a number of investors out there who are sitting on a sizable amount of gains which are much greater than mine after taking the contrarian approach for past few months. The market rewards the brave indeed.

Wednesday, June 3

Selling HDB below valuation

Given that the property market is softening now, it is more common to see HDB flats selling near or at their valuation. In fact, it is possible to see that there are HDB flats selling below valuation. If you are contemplating to sell your HDB flat below valuation and you have used CPF funds to finance your HDB flat, do keep in mind that you may be required to refund back any shortfall in your CPF refund if the sales proceed is insufficient to pay back this refund. This CPF refund is the amount which you have drawn out from CPF to service your housing loan plus accrued interest. This can be illustrated by a simplified example below.

Given that the property market is softening now, it is more common to see HDB flats selling near or at their valuation. In fact, it is possible to see that there are HDB flats selling below valuation. If you are contemplating to sell your HDB flat below valuation and you have used CPF funds to finance your HDB flat, do keep in mind that you may be required to refund back any shortfall in your CPF refund if the sales proceed is insufficient to pay back this refund. This CPF refund is the amount which you have drawn out from CPF to service your housing loan plus accrued interest. This can be illustrated by a simplified example below.